Does replacing your roof lower your homeowners insurance 3

Understanding How Your Roof Affects Your Insurance Costs

Does replacing your roof lower your homeowners insurance? Yes, it can—and often significantly. Most homeowners who replace their roof see premium reductions ranging from 5% to 35%, with the national average hovering around 20%. However, the actual savings depend on several factors including your roof’s age, the materials you choose, and your location.

Quick Answer: Key Factors That Affect Your Savings

- Roof Age: Homes with roofs 10 years old or less typically pay lower premiums, while roofs over 20 years old may face higher rates or coverage restrictions

- Materials Matter: Impact-resistant and durable materials like metal or tile can earn bigger discounts than standard asphalt shingles

- How You Replace It: Voluntary replacement for home improvement typically results in better discounts than replacement following an insurance claim

- Your Location: Areas prone to hail, hurricanes, or high winds may see larger premium reductions with upgraded, weather-resistant roofing

If you’ve received a notice from your insurance company about rising rates or potential coverage termination due to your aging roof, you’re not alone. Many Arizona homeowners face this situation as their roofs age in our harsh desert climate. The good news? Replacing your roof isn’t just about avoiding insurance headaches—it’s a strategic investment that can lower your annual premiums while protecting your home.

This guide will walk you through exactly how roof replacement impacts your homeowners insurance, what factors insurers consider, and the specific steps you need to take to claim your discount. We’ll also explain when insurance will pay for a new roof versus when it’s your responsibility, so you can make informed decisions about this major home investment.

Why a New Roof Can Lead to Lower Insurance Premiums

We often think of our roof as simply the top layer of our home, keeping the elements out. But to an insurance company, your roof is much more than that—it’s a critical indicator of risk. A new, well-installed roof significantly reduces the likelihood of costly claims, which directly translates to potential savings on your homeowners insurance premiums.

Think about it: a brand-new roof is a sturdy shield against Arizona’s intense sun, heavy monsoon rains, and occasional hail. It prevents water damage from leaks, protects the structural integrity of your home, and reduces the chance of expensive repairs down the line. Insurance providers understand this. When your home is less prone to damage, their financial risk decreases, and they pass those savings on to you.

Homeowners who invest in a new roof can typically expect a premium reduction ranging from 5% to 35%. While the national average hovers around 20%, we’ve seen many of our Arizona clients realize substantial savings. For instance, a home with a brand-new roof can cost hundreds of dollars less to insure annually compared to one with a 10-year-old roof. This isn’t just pocket change; it’s a tangible return on your investment, helping offset the How Much is a New Roof costs over time. Inaccurate roof age, in fact, costs home insurers billions in lost premiums each year, highlighting just how much they value an up-to-date roof.

The Simple Answer to “Does Replacing Your Roof Lower Your Homeowners Insurance”

Let’s cut to the chase: does replacing your roof lower your homeowners insurance? The simple answer is almost always a resounding “yes!”

From an insurer’s perspective, a new roof is a sign of proactive home maintenance and a commitment to protecting your property. It lowers their liability significantly. An older roof is a ticking time bomb for potential leaks, wind damage, and structural issues. These problems can lead to expensive claims for water damage, mold, and even interior property damage, which insurers want to avoid.

By replacing your roof, you’re signaling to your insurance company that your home is a lower risk. This proactive step not only offers you peace of mind knowing your home is well-protected but also rewards you with potential premium reductions. It’s a win-win: your home is safer, and your wallet is happier.

How Insurers Calculate Risk Based on Your Roof

Insurance companies are masters of risk assessment, and your roof plays a starring role in their calculations. They use complex actuarial data and extensive claims history to determine how likely your roof is to fail and how much that failure might cost them.

Here’s what they’re generally looking at:

- Likelihood of Leaks and Water Damage: Your roof is the primary defense against the elements. An aging or damaged roof is far more likely to spring a leak, leading to water damage that can affect ceilings, walls, flooring, and even electrical systems. Water damage alone accounted for nearly 30% of losses in 2016, with the average loss totaling over $9,633. This is a huge concern for insurers.

- Wind and Hail Vulnerability: Arizona, especially during monsoon season, can experience strong winds and hail. Older, worn-out roofs are far more susceptible to damage from these events. Wind and hail were the number one cause of loss in 2016, and insurers are keen to minimize their exposure to such claims.

- Overall Condition Assessment: Insurers want to know if your roof is well-maintained or if it shows signs of neglect. Deteriorating shingles, cracked tiles, or visible wear and tear all signal a higher risk. They might even require a professional inspection to assess your roof’s condition before offering coverage or discounts.

- Geographic Location: While our focus is Arizona, it’s worth noting that homes in areas prone to specific weather events (like hurricanes, tornadoes, or heavy snowfall in other states) face different risk calculations. In Arizona, the extreme heat, monsoons, and occasional hail are key factors.

Your roof is crucial because it’s the primary shield against external elements. Any damage or leaks can lead to extensive and costly claims for the insurance company. By reducing these risks, a new roof directly impacts how favorably your insurer views your property. For more insights into how insurers analyze property risks, refer to Data from the Insurance Information Institute.

Key Factors That Determine Your Insurance Discount

When you replace your roof, the potential insurance discount isn’t a one-size-fits-all deal. Several key factors weigh into an insurer’s decision-making process, influencing how much you can save. Understanding these elements can help you make informed choices about your roofing project and maximize your premium reductions.

The main factors that determine your insurance discount include:

- Roof Age: This is often the most significant factor.

- Roofing Materials: What your roof is made of plays a huge role.

- Roof Shape: The architectural design of your roof impacts its resilience.

- Geographic Location: While we’re in Arizona, the specific microclimates and weather patterns in Phoenix, Tucson, Mesa, or Flagstaff can influence rates.

- Installation Quality: A professional, code-compliant installation ensures durability.

The Critical Role of Roof Age and Condition

The age and overall condition of your roof are paramount to insurance providers. It’s often the first thing they ask about and a major determinant of your premium rates.

-

Older Roofs (20+ Years): Many insurance companies consider roofs over 20 years old a significant liability. They are more susceptible to damage from wind, hail, and water, leading to a higher risk of claims. Insurers may respond by:

- Increasing Premiums: You’ll likely pay higher rates to compensate for the increased risk.

- Offering Actual Cash Value (ACV) Coverage Only: Instead of covering the full cost of replacing your roof, they might only cover its depreciated value. This means a much lower payout for you. For example, if a 10-year-old roof originally cost $50,000 but has depreciated by $23,000, an ACV payout (after a $2,000 deductible) would only be $25,000, leaving you to cover the rest.

- Non-Renewal or Refusal of Coverage: Some insurers may refuse to write a new policy or even non-renew an existing one if your roof is too old (e.g., over 40 years). This can leave you scrambling to find coverage.

- Requiring Inspections: They might demand a professional roof inspection before offering or continuing coverage.

-

Newer Roofs (Under 10 Years): Conversely, homes with roofs that are 10 years old or less typically enjoy lower premiums. A new roof signals reduced risk, as it’s less likely to suffer common damage. The difference can be substantial: a 5-year-old roof might see a 6% increase in annual rates compared to a new one, a 10-year-old roof a 12% increase, and a 20-year-old roof a 19% increase. This clearly shows the financial benefit of a newer roof.

Understanding the difference between ACV and Replacement Cost Value (RCV) is crucial here. RCV covers the cost to replace your roof with a comparable new one without factoring in depreciation, leading to a much higher payout and far less out-of-pocket expense for you. Insurers are far more likely to offer RCV for newer roofs. To dig deeper into these coverage types, check out Roof insurance: ACV vs. replacement cost.

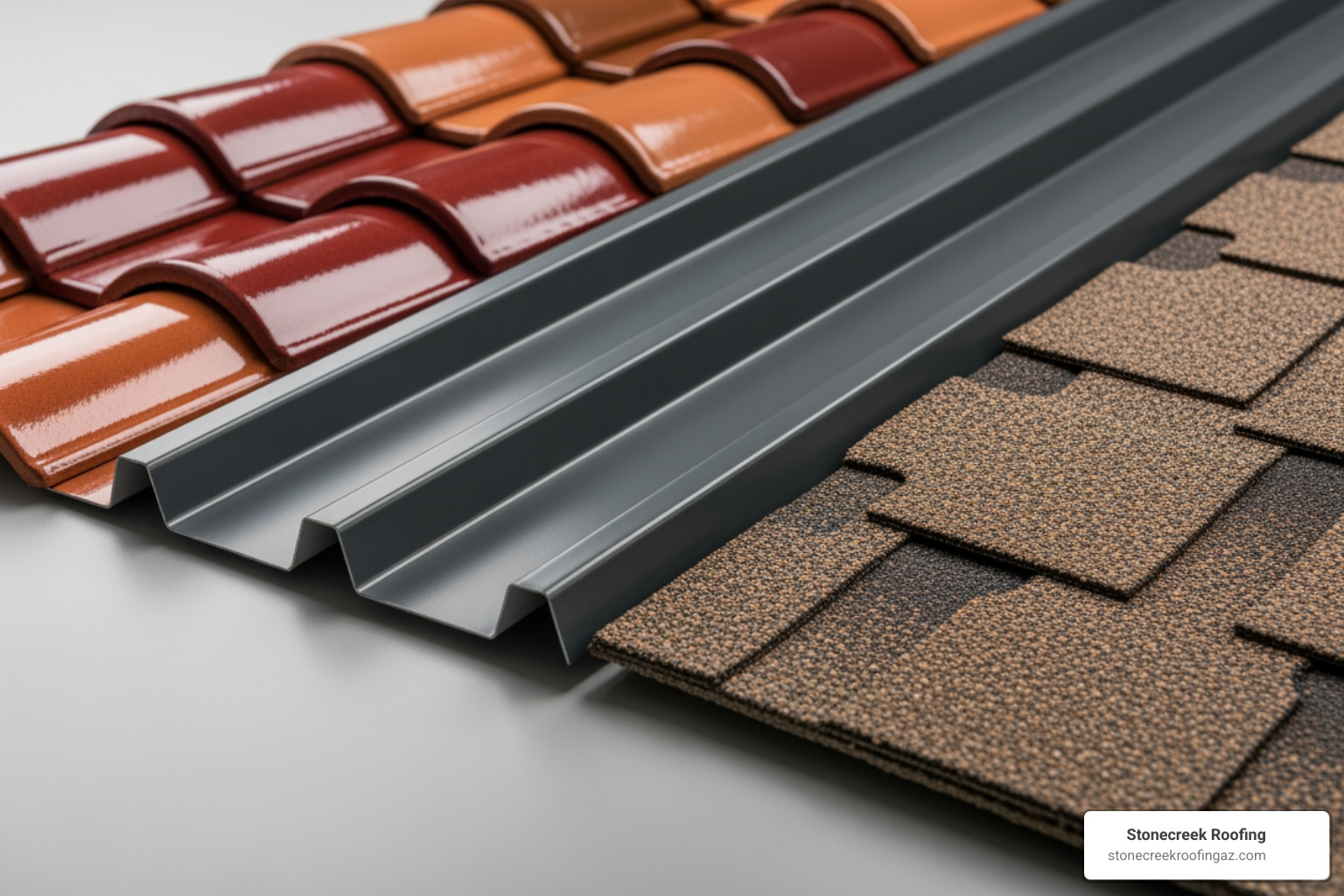

How Roof Materials and Shape Impact Your Premium

The type of material your roof is made from and its architectural shape are also critical factors for insurance companies, especially in Arizona’s climate.

| Roofing Material | Typical Lifespan (Arizona) | Durability & Resilience | Insurance Favorability |

|---|---|---|---|

| Asphalt Shingles | 15-25 years | Moderate (can degrade in extreme heat) | Standard, but less favorable than others |

| Tile (Clay/Concrete) | 30-50+ years | High (excellent heat, fire, wind resistance) | Highly Favorable |

| Metal (Steel/Aluminum) | 30-50+ years | Very High (excellent heat, fire, wind, hail resistance) | Highly Favorable |

Materials Matter:

- Tile and Metal Roofs: In Arizona, tile (clay or concrete) and metal roofs are highly favored by insurers. These materials offer superior durability and a longer lifespan (30-50+ years, with some metal roofs lasting up to 70 years) compared to traditional asphalt shingles. They are excellent at resisting extreme heat, fire, and wind, which are significant concerns in our region. A house with a metal or tile roof can cost substantially less to insure.

- Impact-Resistant Materials: Some roofing materials, including specialized asphalt shingles, are designed to be impact-resistant (often rated Class 4). These materials can withstand hail and flying debris better, leading to fewer claims. Insurers often offer specific discounts for these upgrades.

- Fire Resistance: With wildfire risks in some parts of Arizona, fire-resistant materials like tile and metal are a big plus for insurers.

Roof Shape:

The shape of your roof influences how well it can withstand high winds, shedding water, and its susceptibility to damage.

- Hip Roofs: These roofs slope inward on all sides, creating a strong, stable pyramid-like structure. They are excellent at resisting wind uplift and are generally viewed very favorably by insurers.

- Gable Roofs: Characterized by their triangular shape, gable roofs are common but can be more susceptible to wind damage than hip roofs, especially at the edges.

- Flat Roofs: Less common for residential homes in Arizona but used for some modern designs, flat roofs can be a concern for insurers due to potential water pooling and drainage issues, which can lead to leaks and water damage. They typically have shorter lifespans and can negatively impact insurance rates.

Choosing durable materials and a wind-resistant shape not only protects your home but can also significantly lower your premiums. For more on how a new roof, including material choices, can improve your property, see Boosting Your Mesa Homes Value With a New Roof.

Does Replacing Your Roof Lower Your Homeowners Insurance Proactively vs. Through a Claim?

The answer to does replacing your roof lower your homeowners insurance can also depend on why you’re replacing it. There’s a significant difference in how insurers view a proactive replacement versus one initiated by an insurance claim. Understanding this distinction is key to managing your rates and expectations.

Generally, insurance policies cover sudden, accidental damage from “covered perils” like storms, fire, or falling objects. However, they almost never cover damage from normal wear and tear, neglect, or lack of maintenance. This distinction determines whether your insurer will pay for a replacement and how it might affect your future premiums.

Proactive Replacement: The Smart Investment for Savings

Deciding to replace your roof before a major issue forces your hand is a smart, long-term investment. This “voluntary replacement” is driven by your desire to upgrade, improve your home’s protection, and prevent future problems, rather than responding to existing damage.

When you proactively replace an aging roof, you’re taking a significant step to reduce the risk of future claims. This is highly attractive to insurance companies. They see you as a responsible homeowner who is actively mitigating their risk exposure. As a result, you are much more likely to secure lower premiums and better coverage terms. A new roof is a significant investment—the average cost of replacing a roof is around $9,520—but the long-term savings on insurance and the increased protection for your Arizona home make it worthwhile. We can help you explore Roof Replacement Financing Guide options to make this investment manageable.

Insurance Claims: When Will Insurance Pay for a New Roof?

While proactive replacement is ideal for maximizing savings, sometimes disaster strikes, and you need your insurance to step in. Homeowners insurance will typically pay for a new roof if the damage is caused by a covered peril.

Common covered perils include:

- Storm Damage: This is a big one in Arizona. Wind and hail damage from our monsoon storms are frequently covered.

- Fire: Damage to your roof’s structure or materials due to a fire is almost always covered.

- Falling Objects: If a tree branch falls on your roof during a storm, or any other object causes direct damage, it’s usually covered.

- Vandalism: Intentional damage to your roof can also be covered.

It’s crucial to remember that insurance will not cover damage from normal aging, wear and tear, or neglect. If your roof is leaking simply because it’s old and hasn’t been maintained, that’s generally your responsibility.

When insurance does cover a replacement, you will still be responsible for your policy’s deductible. This is the amount you pay out of pocket before your insurance coverage kicks in. Filing a claim is a process, and we can help guide you through it. To learn more about navigating this, visit our page on How to Get Insurance to Pay for Roof Replacement.

Your Step-by-Step Guide to Claiming Your New Roof Discount

So, you’ve decided to replace your roof, or perhaps you’ve already had it done. Fantastic! Now, how do you make sure your insurance company knows about it and gives you the discount you deserve? It’s not enough to simply install a new roof; you need to proactively communicate and provide documentation to your insurer.

Here’s our step-by-step guide to claiming your new roof discount:

Step 1: Hire a Reputable Contractor and Get a Permit

This step is foundational, whether you’re replacing your roof proactively or through an insurance claim. Always choose a licensed, bonded, and insured roofing company. A reputable contractor ensures a quality installation that meets local building codes and manufacturer specifications, which is vital for both your home’s integrity and your insurance coverage.

In Arizona, a permit is often required for roof replacement. Your chosen contractor should handle securing all necessary permits. Quality installation by certified professionals means your new roof will be durable and less prone to future issues, making it more attractive to insurers. We pride ourselves on being a top-rated Phoenix-based roofing company, ensuring all our work is up to code and of the highest standard. If you’re unsure about the permit process, our team can help clarify if you Need Permit for Roof Replacement in your area.

Step 2: Notify Your Insurance Agent

Once your new roof is installed, or even before you start the project, it’s a good idea to discuss your plans with your insurance agent. Inform them about the replacement, including the completion date and details about the contractor you used.

Your agent will want to update your policy to reflect this significant improvement to your home. This is a crucial step because if you don’t inform your insurer of structural changes, you might encounter coverage issues if you need to file a claim later. Plus, they can start the process of applying any applicable discounts.

Step 3: Provide All Necessary Documentation

To secure your premium reduction, your insurance company will require proof of the new roof. Be prepared to provide them with:

- Final Invoice: A detailed receipt from your roofing contractor showing the full cost of the project.

- Material Warranty: Documentation from the manufacturer outlining the warranty on the roofing materials.

- Contractor’s Warranty: Any warranty provided by your roofing company for their workmanship.

- Before-and-After Photos: Visual evidence of the old roof and the newly installed one can be very helpful. Date-stamped photos are even better.

- Permit and Inspection Records: Proof that the work was done legally and passed any required inspections.

Providing thorough documentation demonstrates the quality and legitimacy of your roof replacement, making it easier for your insurer to process your discount. For comprehensive information on protecting your investment, explore Roof Warranties What Homeowners Should Know.

Frequently Asked Questions About Roofs and Insurance Rates

We understand that navigating roofing and insurance can bring up a lot of questions. Here are some of the most common ones we hear from our Arizona homeowners:

How much does replacing your roof lower your homeowners insurance?

As we’ve discussed, does replacing your roof lower your homeowners insurance is typically a “yes,” and the savings can be significant. Homeowners can realize a reduction in premiums anywhere from 5% to 35%, with the national average hovering around 20%.

The exact amount will depend on several factors:

- The age and condition of your old roof: The older and more damaged your previous roof, the greater the potential discount for a new one.

- The materials you choose: Upgrading to more durable, impact-resistant, or fire-resistant materials like metal or tile often yields larger discounts.

- Your specific insurer and policy: Different companies offer varying discounts.

- Your geographic location: In areas like Arizona, where extreme heat, monsoons, and occasional hail are factors, a new, resilient roof can lead to substantial savings by reducing the risk of weather-related claims.

For instance, a new roof can save you an average of $363 per year compared to a 10-year-old roof, and replacing a 20-year-old roof could reduce premiums by up to 21%.

Does the age of a roof affect homeowners insurance?

Absolutely, the age of your roof is one of the most critical factors influencing your homeowners insurance rates. Insurers see older roofs as a higher risk for several reasons:

- Increased Vulnerability: As roofs age, materials degrade, becoming more susceptible to leaks, wind damage, and hail impact. This translates to a higher likelihood of expensive claims.

- Higher Premiums: Homeowners with older roofs (typically over 10-15 years) will generally pay higher premiums. For example, a 5-year-old roof might see a 6% increase in rates compared to a new one, escalating to a 19% increase for a 20-year-old roof.

- Coverage Restrictions: Many insurers have age limits for full Replacement Cost Value (RCV) coverage. For roofs older than 15-20 years, they might only offer Actual Cash Value (ACV) coverage, which pays out significantly less due to depreciation.

- Non-Renewal or Denial of Coverage: Some insurance companies may refuse to write new policies or non-renew existing ones for homes with roofs older than 20 years, and many won’t write a policy if your roof hasn’t been updated in the last 40 years. They may even deem roofs over 20 years old “uninsurable.”

Conversely, newer roofs (under 10 years old) are viewed favorably, leading to lower premiums and better coverage options. Keeping your roof updated is key to maintaining affordable and comprehensive homeowners insurance.

Should I contact my insurance company or a roofing company first after storm damage?

This is a common dilemma for homeowners in Arizona after a monsoon storm. While your immediate instinct might be to call your insurance company, our best practice recommendation is to contact a reputable roofing company like Stonecreek Roofing first.

Here’s why:

- Expert Damage Assessment: A professional roofing contractor can conduct a thorough inspection, identify all damage (even hidden issues), and provide an accurate, unbiased assessment. They can differentiate between storm damage and pre-existing wear and tear.

- Detailed Report and Estimate: We can provide you with a detailed report of the damage, including photos, and a professional estimate for repairs or replacement. This expert documentation is invaluable when you do file your claim.

- Guidance on the Process: An experienced roofing company that works with insurance claims regularly can offer guidance on the claims process, helping you understand what to expect and ensuring you have all the necessary information before speaking with your insurer.

- Avoid Premature Claims: If the damage is minor and below your deductible, or if it’s clearly not covered (e.g., wear and tear), a roofing inspection can save you from filing an unnecessary claim that could potentially impact your future rates.

Once you have a professional assessment and estimate from us, you’ll be much better prepared to call your insurance company and file a claim. This approach helps ensure a smoother process and a more favorable outcome. For more detailed advice, visit our page on whether to Contact Insurance First or Roofing Company.

Maximize Your Savings with a Professional Roof Replacement

We’ve explored in depth how does replacing your roof lower your homeowners insurance and the many factors that contribute to those savings. From the critical role of roof age and material to the distinction between proactive replacements and insurance claims, it’s clear that a new roof is more than just an aesthetic upgrade—it’s a smart financial decision and a vital investment in your home’s protection.

A quality roof replacement offers dual benefits: unparalleled protection for your home against Arizona’s challenging climate and significant financial savings through reduced insurance premiums. By choosing durable materials, ensuring professional installation, and proactively communicating with your insurance provider, you can truly maximize these advantages.

At Stonecreek Roofing, we understand the unique roofing needs of homes across Phoenix, Tucson, Mesa, and throughout Arizona. Our customer-first approach, combined with over 500 5-star reviews, reflects our commitment to quality, durability, and helping you steer every step of your roofing journey—including understanding and leveraging your insurance benefits. When you choose us, you’re not just getting a new roof; you’re investing in peace of mind and long-term savings.

Ready to protect your home, lower your insurance rates, and boost your property’s value? Learn more about our roof insurance claim assistance and let us help you build a stronger, more affordable future for your home.